Do you know how much it takes to create a secure retirement?

Use this calculator to help determine what size your retirement nest-egg should be.

Your Results

Years Until Retirement

Estimated annual retirement expenditures

Projected nestegg required

Projected nestegg required after current Saving

Your last year's income

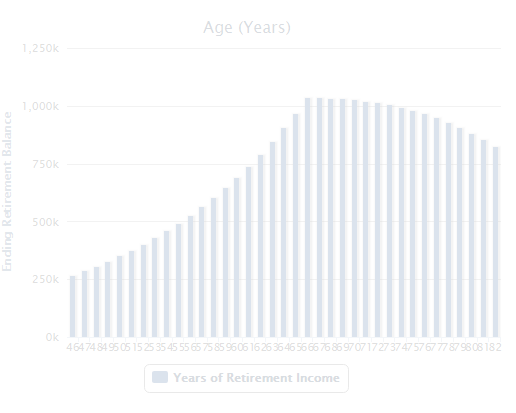

Ending Balance

Projected nestegg required

after NIB Benefits

Definitions

- Current Age

Your current age.

- Age of retirement

Age you wish to retire. This calculator assumes that the year you retire, you do not make any contributions to your retirement savings. So if you retire at age 65, your last contribution happened when you were actually age 64. This calculator also assumes that you make your entire contribution at the end of each year.

- Household income

Your total household income. If you are married, this should include your spouse's income.

- Current retirement savings

Total amount that you currently have saved toward your retirement. Include all sources of retirement savings such as personal pension, plans, IRAs and Annuities.

- Expected income increase

Annual percent increase you expect in your household income.

- Years of retirement income

Total number of years you expect to use your retirement income.

- Income Required at Retirement in (%)

The percentage of your retirement household income you think you will need in retirement. This amount is based on the household income earned during the year immediately before your retirement. You can change this amount to be as low as 40% and as high as 160%. To help you determine how much income you will require, consider if you will have mortgage payments, college tuition and other bills to pay. Also think about the lifestyle you hope to have. Will you be taking an annual trip, do you have any hobbies that you plan to spend more time doing like playing golf, etc.

- Rate of return before retirement

This is the annual rate of return you expect from your investments. The actual rate of return is largely dependent on the types of investments you select. Contact your pension provider for these figures.

It is important to remember that these scenarios are hypothetical and that future rates of return can't be predicted with certainty and that investments that pay higher rates of return are generally subject to higher risk and volatility. The actual rate of return on investments can vary widely over time, especially for long-term investments. This includes the potential loss of principal on your investment. It is not possible to invest directly in an index and the compounded rate of return noted above does not reflect sales charges and other fees that funds and/or investment companies may charge.

- Rate of return during retirement

This is the annual rate of return you expect from your investments during retirement. This rate is often lower than the return earned before retirement due to more conservative investment choices to help insure a steady flow of income. Contact your pension provider for these figures.

It is important to remember that these scenarios are hypothetical and that future rates of return can't be predicted with certainty and that investments that pay higher rates of return are generally subject to higher risk and volatility. The actual rate of return on investments can vary widely over time, especially for long-term investments. This includes the potential loss of principal on your investment. It is not possible to invest directly in an index and the compounded rate of return noted above does not reflect sales charges and other fees that funds and/or investment companies may charge.

- How we estimate NIB (National Insurance) Benefits

We estimate your NIB benefits based on the assumption that you will have worked at least 35 years and will start collecting benefits at age 65. For most people who are working today, that's considered full retirement age. If you plan on retiring after age 65, we assumed the benefits are invested (along with your savings) and grown at the same average rate of return of 6%. We use your estimated pre-retirement income to calculate your estimated annual NIB benefits, based on current benefit formulas and accounting for inflation.