Three types of structures operate as investment companies: open-end funds, closed-end funds, and unit investment trusts. Although only open and closed-end funds are offered in the Bahamian Dollar market, several other types of funds are commonplace elsewhere.

Unit Investment Trust (UIT)

These structures operate similarly to an open-end mutual fund. However, they differ in several important ways:

- Legally, they are established as trusts, as the name implies, and are governed by a trust deed.

- From an investment perspective, they are typically passive in nature and do not actively trade securities.

- They offer investors units rather than shares.

- They are typically established with a predetermined termination date.

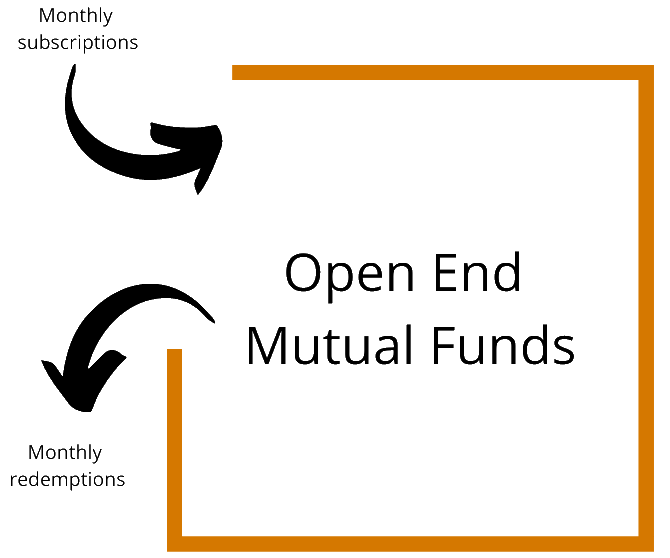

Open-End Fund

This investment company offers shares on a continuous and unlimited basis and allows for the redemption of shares by shareholders on a scheduled basis.

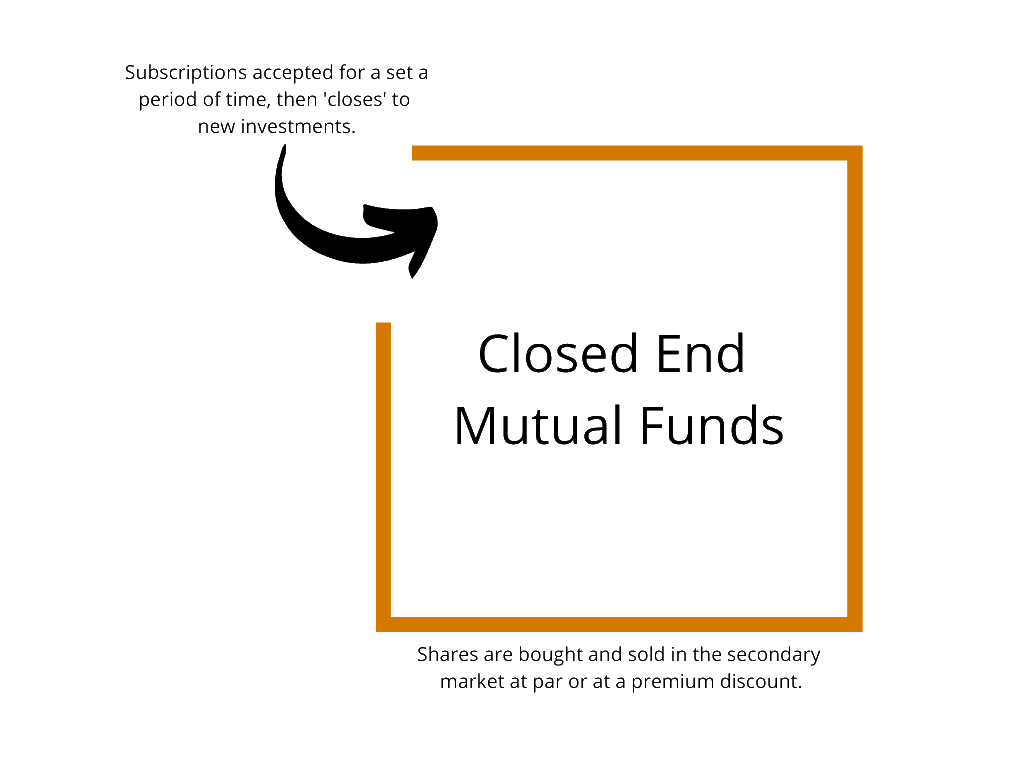

Closed-End Fund

Closed-end funds are investment companies that are characterized by the initial offering of their shares only during a specified period of time. Thereafter, the fund is closed with the trading of its shares conducted through an exchange, usually at a premium or discount to the fund’s net asset value.

Closed-End funds occupy the other end of the Collective Investment Scheme spectrum, only offering a predetermined number of shares for sale for a specified period of time.

As the name indicates, the fund then “closes” and any investor who wishes to purchase shares must do so from an existing investor in the secondary market through an Exchange, often at either a discount or premium to the Net Asset Value of the fund itself (i.e.the net value of the underlying portfolio of assets the fund owns).

Exchange-Traded Fund (ETF)

These funds are the new kids on the investment block, having made their debut only 20 years ago, but today represent more than $2.5 trillion of overall US investment company assets. Typically established as an open-end investment company, an ETF nonetheless trades on stock exchanges at market-determined prices, just like a stock or bond. Although they typically mirror a portfolio of securities—such as a global equity index or a basket of energy stocks—they trade like individual security and can be bought and sold throughout the day.

.png)