- April 2, 2025

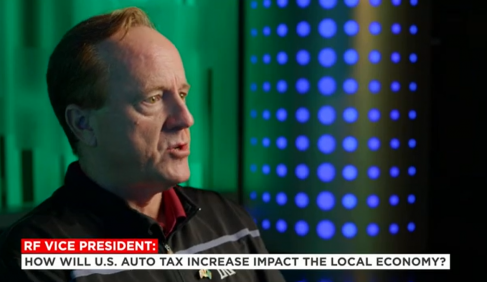

By David Slatter, Vice President of Investments, RF Bank & Trust

As we close the first quarter of 2025, we find ourselves at a critical juncture—one that is defined by rapidly evolving global dynamics and significant economic uncertainties. The theme of the RF Bahamas Economic Outlook Conference, held on March 12, 2025, at the Baha Mar Resort in New Providence, “Escalating Global Conflicts: Power Shifts & Opportunities,” aptly captures the essence of the year ahead. This gathering of global thought leaders from various industries provided an opportunity to delve into the challenges and opportunities emerging from these shifts, both on a global scale and within our local context.

Economic conditions, driven by geopolitical tensions and rapidly evolving trade environments, are in a state of flux, forcing even the most seasoned analysts to reassess their forecasts and projections. From my vantage point, having navigated the complexities of the Bahamian financial markets for over 25 years, this period of transition presents not only risks but also potential opportunities for those prepared to adapt.

Renato Grandmont, MD and Chief Investment Strategist at Morgan Stanley, was one of the key speakers at the conference. His expertise shed light on how global financial markets are responding to the swift pace of policy changes, particularly in the U.S. Grandmont emphasized the uncertainty surrounding the impact of U.S. policy decisions, such as those on immigration, tariffs, fiscal policy, and deregulation. While the direction of U.S. policies is known, their consequences, especially on the financial sector, remain unclear. He warned that while a full-scale recession is not expected, there is a 30% chance of “skyflation,” a scenario in which inflation rises dramatically without economic growth to match it.

His advice to investors was clear: diversify and remain neutral in the face of such uncertainty. He recommended maintaining a diversified portfolio across various sectors, with a preference for U.S. equities in industries such as financials, industrials, real estate, and energy infrastructure. He also emphasized the importance of alternative investments to hedge against the volatility that is likely to persist throughout the year. However, he cautioned that risks remain, particularly in the form of policy mistakes, rising geopolitical tensions—especially with China—and the possibility of a market correction in U.S. equities.

As we look closer to home, the Bahamian economy’s prospects are closely tied to global trends, especially in tourism, which remains our primary economic driver. The good news is that tourism in The Bahamas is holding steady, with an encouraging rise in cruise arrivals in recent months. The expansion of Carnival’s Celebration Cay underscores growing confidence in The Bahamas as a premier cruise destination.

This growth presents opportunities for The Bahamas, but also risks. The U.S. remains a vital source of tourism, accounting for approximately 85% of our visitors, and its economic trajectory will significantly impact our tourism sector. Protectionist policies and geopolitical tensions, combined with the potential for a market correction in overvalued U.S. equities, could dampen tourism and, by extension, economic growth in The Bahamas. The Caribbean Development Dynamics 2025 report from the OECD and Inter-American Development Bank highlights that while tourism is crucial, regional economies—including ours—must address significant challenges such as high debt levels, low financial depth, and vulnerabilities to climate change.

Against this backdrop, the importance of a diversified investment strategy cannot be overstated. Bahamian equities, as measured by the BISX All Share Index, have demonstrated remarkable long-term performance. Since its inception in 2000, the index has grown by over 200%, reflecting an annualized return of approximately 8.4%. When factoring in dividend yields, total returns have exceeded 10% annually. This performance serves as a reminder that long-term investment success is built on consistency and discipline. As investment legend Kenneth Fisher once said, “Time in the market beats timing the market.” While volatility will continue to be a factor, staying the course with a well-diversified portfolio is often the best strategy.

At RF Bank & Trust, we believe that success is about preparation and adaptability. Our investment approach in 2025 remains focused on these principles—moving with the market, not behind it. We are committed to helping our clients navigate the complexities of this rapidly changing environment, providing them with the tools and insights needed to make informed decisions. As we’ve seen in the past, those who are prepared to embrace change and seize opportunities in uncertain times will be best positioned for success. In the words of a seasoned investor: don’t wait for the future—build it.

For more insight on exactly how the US tariffs can impact The Bahamas, watch my interview with Our News: RF Video Clip

Secure Your Financial Future with RF Bank & Trust

As the Bahamian market continues to evolve, now is the time to position yourself for growth and long-term returns. At RF Bank & Trust, we offer a comprehensive suite of investment products and services designed to help you achieve your financial goals. Whether you are an experienced investor or just starting your journey, our expert team is here to guide you in creating a portfolio tailored to your aspirations. Start investing today and experience the confidence that comes with a trusted financial partner. Contact RF Bank & Trust to take the first step toward securing your future.