The History of Mutual Funds (at a glance)

The Global Growth of Mutual Funds

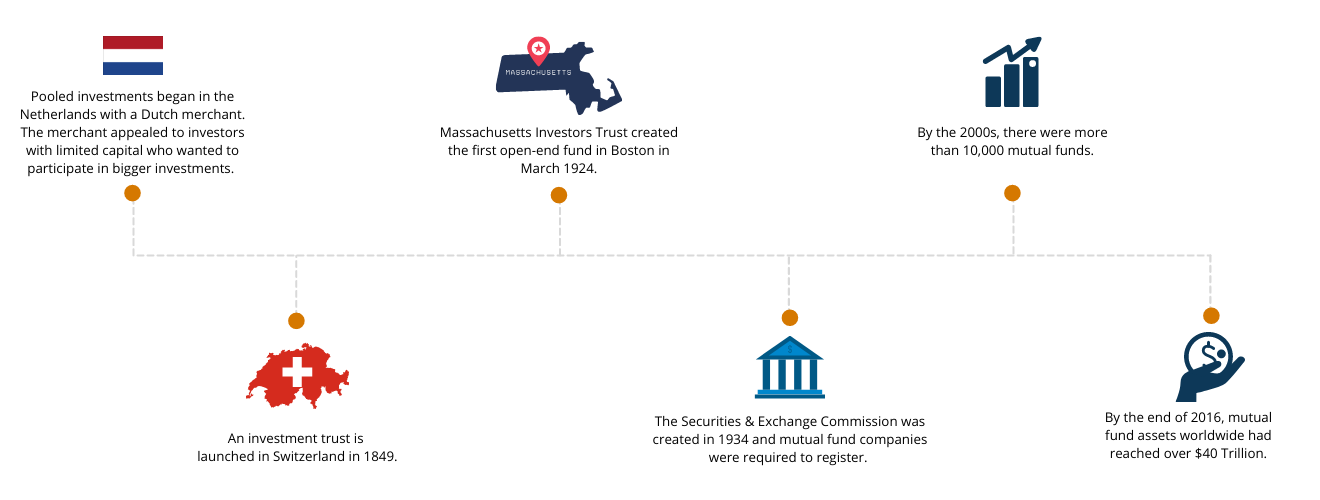

Mutual funds are pooled investments which means that they combine contributions from many different people under an investment company and then purchase a portfolio of assets for the benefit of shareholders (also known as collective investment schemes). Since their emergence in the Netherlands in the 1700s, mutual funds have become a popular investment tool worldwide.

The concept of pooled investing dates back to the late 1700s in Europe when a Dutch merchant and broker invited subscriptions from investors to form a trust to allow small investors with limited means to participate in larger investments. Typically, these structures required investors to keep their money within the pool for the entire lifespan of the company, and the actual investments made were often concentrated in one industry or even one company.

The Massachusetts Investors Trust created the first open-end fund in Boston in March 1924, introducing important changes to the investment company concept in the process, including a simplified capital structure, continuous offering of shares, ability to redeem shares rather than hold them until the dissolution of the fund, and a set of clear investment restrictions and policies. This became the blueprint for many open-end mutual funds today, in the Caribbean and elsewhere.

By the end of 2016 in the United States, investment companies managed a whopping $19.2 Trillion in net assets on behalf of investors in various types of funds (including Mutual Funds, Exchange Traded Funds, Closed-end Funds, and Unit Investment Trusts). However, the lion’s share of this total—or $16.3 Trillion—was managed within mutual funds. These numbers dwarf the total amount of assets invested in Caribbean-based mutual funds, estimated to be approximately $2.2 billion today. Nevertheless, the usefulness of the mutual fund structure as an effective and flexible financial planning tool for most investors transcends national boundaries.

Mutual Funds in the Caribbean

Mutual funds have played a significant role in the growth of the capital markets throughout the Caribbean after first being introduced in Trinidad & Tobago, Jamaica and Barbados in the 70s and 80s. Through their branch networks in the region, various international banks extended the reach of the investment option by introducing clients to the funds that their teams were managing back in their home countries.

At the same time that individual company stocks and bonds were being listed on security exchanges throughout the region, generally, risk-averse investors were becoming intimately familiar with the risk level associated with individual ownership of stocks (especially after the financial crisis of 2008!) Caribbean investors looked for a more stable and diversified approach to investing, and mutual funds became a logical alternative. While not immune from the fluctuations of stock prices in the market, mutual funds offered investors two main advantages that individual securities in thinly traded markets did not - diversification and liquidity.

.png)