The Corporate Trustee

The RF Cayman Pension Plan (the “Plan”) is administered by a Corporate Trustee - RF Bank & Trust (Cayman) Limited which operates under a Category A Bank & Trust Licence and is regulated by the Cayman Islands Monetary Authority (“CIMA”).

There are many benefits of having a Corporate Trustee, the most notable being experience you can trust and higher levels of regulation.

Experience

The RF Group has over 20 years of experience in providing the full range of trustee, administration, and investment management services to pension plans across the Caribbean region. Whether through our regional multi-employer pension funds or stand-alone pension funds, the RF Group provides a “one-stop shop” for all pension requirements, including both defined benefit and defined contribution plans.

Regulation

The RF Cayman Pension Plan is regulated by the Department of Labour and Pensions and RF Bank & Trust (Cayman) Limited is regulated by Cayman Islands Monetary Authority (CIMA).

Trustee Duties

The key duties of a trustee are to:

-

Act in accordance with the trust deed and rules

-

Act prudently, responsibly and honestly

-

Act in the best interests of your beneficiaries

-

Act impartially

How does the Trustee operate?

The Board of RF Bank & Trust (Cayman) Limited appoints a Trustee Committee, comprising management, trust officers and investment managers, that meet monthly to review the investment performance of the Plan and any other trustee related matters.

The Board of RF Bank & Trust (Cayman) Limited meets quarterly to review the business of the company as well as the Plan.

Who advises the Trustee?

Legal Advisors

Carey Olsen

Bankers

RF Bank & Trust (Cayman) Limited

Auditors

PricewaterhouseCoopers

Investment Manager

RF Bank & Trust (Bahamas) Limited

The Investment Manager works with a range of active and “best of breed” international asset managers to create a series of diversified investment portfolios to meet the risk and return requirements of the various Plan participants.

Pension Administrator

RF Bank & Trust (Cayman) Limited

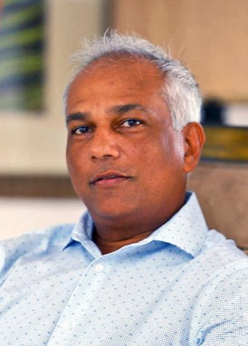

Who are the Trustee Directors?

Michael Anderson

Group President & Chief Executive Officer

Brett Hill

President & CEO

Marla Dukharan

Board Member

Ross McDonald

Board Member

Thomas Hackett

Board Member1.png)

Nicholas Freeland

Board Member